The free tax-filing service is available at the Socorro Public Library through appointments only.

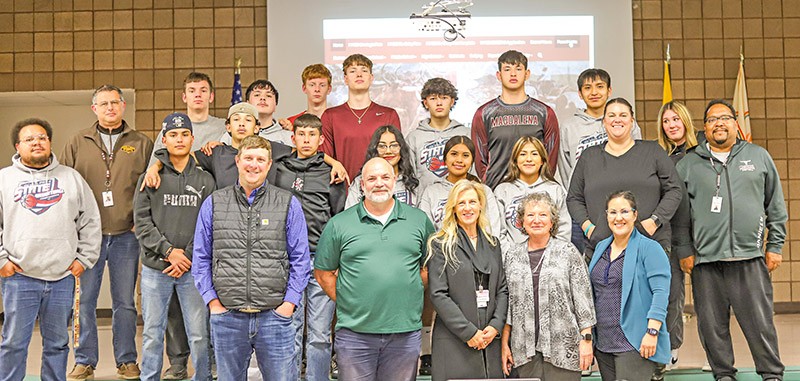

John Larson | El Defensor Chieftain photo

By now everyone should have received their W-2s and other income documentation, which means it’s time to start planning for that great American tradition of filling out income tax forms. That task can be made a little easier this year, thanks to a program at the Socorro Public Library.

Beginning Wednesday, Feb. 17, seniors and lower-income taxpayers will be able to take advantage of a free tax preparation service provided by Tax Help New Mexico.

The free service – for people whose household income is $57,000 or less or for those who are 65 years or older – is made possible by a partnership between the United Way of New Mexico, and the VITA program of the Internal Revenue Service.

Socorro’s on-site coordinator is Mary Nutt.

“We want to make sure everybody who needs help to take advantage of this free service,” Nutt said. “We will prepare and file your state and federal taxes for free, but this year, due to COVID-19, the process has changed. It’s going to be quite different.”

All tax preparation will be done by appointment only and taxpayers will not be able to stay in the library while their taxes are being completed due to Covid-19 restrictions.

“Everybody used to just come in here, stand around in line until we got to them,” she said. “Some days there’d be a line out the door, and we’d have maybe 50 to 60 people standing here. Can’t do that this year.”

This year people can sign up in one of two ways.

“We mailed forms to everybody whose taxes we did last year. Those people should have received them by now,” Nutt said. “If we didn’t do your taxes last year, you can pick the intake forms up at the library. Or, you can call the library and say you want to have your taxes done, and the forms will be sent to you.”

Library hours are 8 a.m. to 1 p.m., but the staff is there until 5 p.m.

“They’ve been really helpful,” she said. “They want this program and the mayor wants this program, so they are willing to make appointments for us.”

People then show up at their appointment time with their intake forms and tax documents and

somebody will do an intake check with them.

“If it’s nice we’ll do it outside,” Nutt said. “Then their packet goes upstairs to the Alice Kase Room on the second floor and the tax people crank out the taxes. So the big difference is that tax preparers will not be sitting with the taxpayer, as before.”

Participants will not be able to spend the day in the library due to COVID-19 regulations.

“We will phone you when your taxes are done and you can return to the library to review, sign, and pick up a copy of your return,” she said. “Most returns can be completed in an hour or two.

All volunteers are certified by the IRS, and trained to help taxpayers identify tax credits for which they are entitled.

“Our whole purpose to make it easy for seniors and lower-income taxpayers to file,” Nutt said. “Even if you had no income last year you may be entitled to a refundable tax credit.”

The service includes the preparation of both Federal and New Mexico returns.

What participants need to have at their appointment time:

• A government-issued photo ID, Social Security Card, or Individual Tax Identification Card (ITIN) for yourself, your spouse, your dependents, or anyone else on your return.

• Both Intake Sheets

• Income Tax Forms: All W-2 forms and 1099 forms

• Healthcare Form 1095-A, if insurance purchased through the Marketplace

• Economic Impact Notices 1444 and 1444-B, if you received a Stimulus Payment.

• Expense Forms: All 1098 Forms, child or dependent care expenses, property tax payments

• Prior Year Tax Return

• Bank routing and account number if you qualify for a refund and want a direct deposit or if you owe money and want a direct debit from your bank account. Or a voided check.