The Socorro County valuation has increased by $8 million. The county assessor’s office is in the process of reappraising all property values in the county. Currently the office is working on reappraising property values in Veguita.

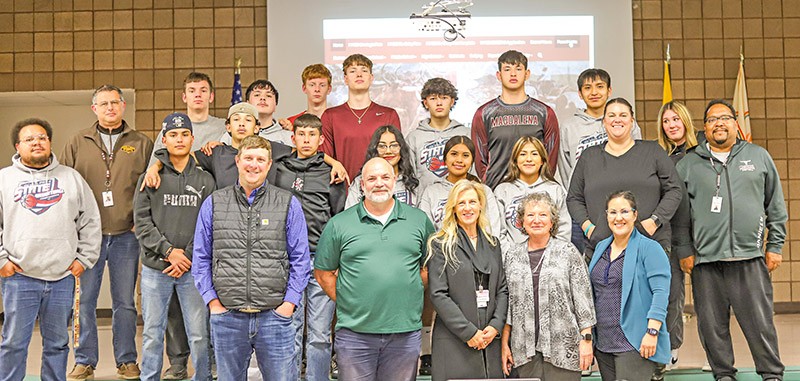

John Larson | El Defensor Chieftain

The value of property in Socorro County increased by $8 million, despite a high dollar amount in petitions for property value reductions.

The county valuation totals $232 million for 2020. There are petitions for $3.2 million in valuation. There is $228 million in unprotested valuation, an increase of $8 million from the previous year.

The protests are primarily from hotels and restaurants in the city of Socorro that lost income during the COVID-19 pandemic last year, said County Assessor Julie Griego. While the number of petitioners is similar to years past, said Griego, the dollar amount being petitioned is higher. In a typical year, around $1 million would be petitioned.

The $8 million valuation increase should result in approximately $80,000 in additional property tax dollars for the county. The county valuation is used to determine an appropriate tax rate for property taxes. Property taxes help fund the city, the county, local water entities, the hospital, the state and local school districts.

Petitions are a normal part of the process and property owners are encouraged to petition valuations that they think are incorrect, said Griego. Appraisers have to take in many factors when assessing property value, including the dimensions of a structure, heating and cooling systems and the condition of the roof. Sometimes appraisers are not able to closely inspect a property when they go to assess its value. An appraiser may see a structure behind a house without being able to assess it directly and believe it is a house, when in reality it is a storage shed. Then the property owner can protest that incorrect valuation to make sure it is accurate.

“It’s your right to protest,” said Griego. “It keeps us honest, makes sure we’re doing the right thing, doing what we need to do.”

The assessor’s office is in the middle of a mass reappraisal, where appraisers visit every single property in the county to reassess property value. During the mass reappraisal, the assessor’s office finds homes that were never put on the tax rolls and adds them to the tax rolls.

Appraisers also adjust property values for additions that were not reported, like a porch or garage. Typically when homeowners build such additions, they get a permit from the state, which sends the information to the assessor’s office. But not everyone gets the correct permit or notifies the assessor’s office, so the mass reappraisal allows the office to take account of previously unreported property value increases.

The reappraisal is an especially large task because of the rural nature of Socorro County. In some areas of the county it can take appraisers a full day to locate and reappraise two homes, because the properties are so isolated.

Griego is hopeful the mass reappraisal will be finished in 2022. The process began in 2016 and was delayed first by a technical difficulty that forced employees to re-enter already gathered data and then by the COVID-19 pandemic. The assessor’s office is currently reappraising property values in Veguita and still needs to assess Lemitar, Polvadera, land in the east part of the county on the route to Moriarty and vacant land in the south part of the county. The mass reappraisal is required by state statute.

Appraising property values can pose a safety risk for employees.

“They go out there and you’ve got people that are going to run them off the property. They’ll threaten to shoot them. People don’t want you on their property,” said Griego.

Legally the appraisers are allowed to go on private property unless there is a no trespassing sign or locked gates. The office’s employees always go to isolated areas in pairs and have been instructed not to enter any property with dogs. Instead they take photos and do their best to assess the property value from the road.

Griego would like the office to eventually acquire technology that takes aerial images of property and 3D images buildings, to make it easier, more efficient and safer for her employees to assess property values.

There are several different property tax exemptions residents can qualify for. People can get a head of household exemption for their primary residence, there are exemptions for veterans and disabled veterans, and people who make less than $35,000 can apply for a low income freeze so that their property values do not go up.

Griego encourages anyone with concerns about their property’s valuation or with questions about the process to visit the assessor’s office and get their questions answered.